W-7 Form

How to

Apply for ITIN

Get Expert Advice

What Is An ITIN?

Form 1040-NR – According to the US laws, the non-resident aliens and the residents of the US have to file a tax return. The Internal Revenue System commonly known as the IRS is a US government agency that is responsible for the filing of tax returns, collection of taxes, and enforcement of tax laws.

The IRS has made several kinds of forms available for filing a tax return. The worldwide income earned by a US citizen is subjected to US tax regardless of their current residence. Form 1040-NR in particular is an income tax return form for the Non-Resident Alien of the US.

Form 1040-NR is usually required for non-resident aliens who are engaged in trade or business in the US or has earned income from other US sources. It is either filed to represent a deceased person who had to file the tax return or represent an estate or trust that had to file the income tax return.

This rule in general applies to all the Green Card Holders, they may only be exempted from filing a tax return if their income falls below the Gross Income threshold or fall under foreign income tax exclusion, which qualifies for very rare cases including a tax home in another country.

A non-resident alien – is an alien who has not passed the green card test or substantial presence test. The non-resident aliens must comply with US tax laws and complete filing form 1040-NR as it cannot be e-filed to obtain visa requirements and get refunds.

Who Needs To Obtain An ITIN?

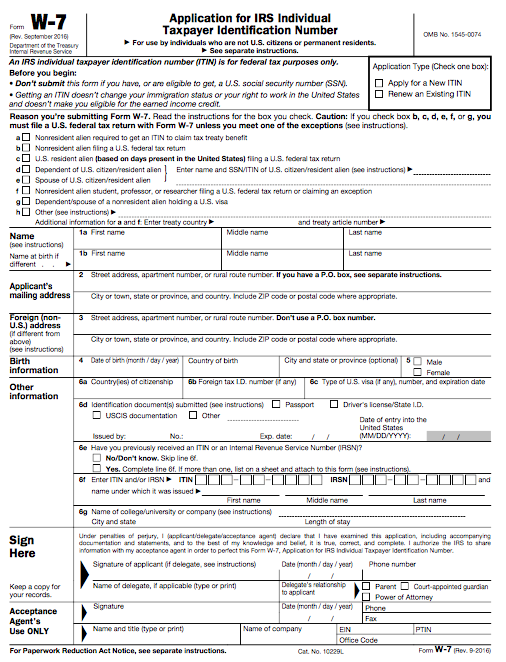

Resident or non-resident aliens of the US have to complete the Form W-7 to apply for an IRS Individual Taxpayer Identification Number (ITIN). One has to note that this application form cannot be e-filed. The ITIN application form, W-7 will require information such as:

- Name

- Birth date and Place

- Identification documents to be attached to the application form such as passport, state-issued ID or driver license

- Foreign residential address and mail addresses

- Immigration status and documents

Who Needs To Obtain An ITIN?

These are the people who may need to obtain an ITIN:

- Non-residents aliens and residents of the US, their dependents, and spouses can apply for ITIN if they are not eligible to obtain an SSN

- Non-resident aliens who are required to file for a tax return

- Resident’s aliens of the US are required to file a tax return due to the number of days they reside in the US

- Non-resident aliens claiming a tax treaty benefit

- Non-resident alien student, professor or researcher filing a U.S. tax return or claiming an exception

- Tax filers who live abroad can also obtain their ITIN

Assistance In Filing The Application Form And Form Renewal

Acceptance Agents are those entities that are authorized by the IRS to assist the applicants in the filing of their form, they review the documents and forward the document to the IRS for processing it. They may charge around $15 – $25 for the application fees and the certified agents may charge differently.

ITINs expire relating to the year in which the taxpayer has filed a return and the specific middle digit number. The taxpayer will have to renew their ITIN when they are notified about its expiration.

The IRS recommends that the taxpayers submit a renewal application to avoid potential delays in processing their refund as it will exempt all the credits claimed and no refund will be paid. To renew an ITIN, the taxpayer will have to submit the completed Form W-7 with all the required and certified documents. They must select an appropriate reason for needing the ITIN. No tax return is required for a renewal application.

Spouses and dependents residing abroad cannot renew forms in advance, they can renew it only while filing a tax return or when someone else files for their claim.

Our Process

At Meru Accounting, we make the Form 1041 return procedure smooth and hassle-free.

Step 02. Processing Documents

Preparation for Tax Return

The relevant information from the documents will be taken into a software of the client's choice by our tax professionals. The scanned copies of the original documents along with the transactions will be saved into the software in order to make them easily accessible. All the copies of the documents would be verified with the source documents.

Auditing of Tax Returns

Our experts will then verify if all the required information has been correctly entered. The Tax expert will then prepare the Tax return report based upon bookkeeping done for the given period and the information received.

Step 03. Final Preparations

Review of Returns

A draft copy of the tax return with the calculated Tax Refunds/ Liability will be sent to the client for review. The draft will include some questions or comments from the Tax expert. The client can request for multiple modifications if needed.

Submission of the Final Copy of the Tax Return to the client

After reviewing the tax returns, the final copy for the income tax return will be sent before the due date. The clients just need to sign and send the Tax return file to the Internal Revenue Service via some designated UPSC courier services like DHL Express, UPS and FedEx. We will take care of all the communications part with the Internal Revenue Service if any query arises.

Track Your Application Status

Taxpayers who have filed their applications generally receive notifications from the IRS or obtain the ITIN within six weeks.

In case, the taxpayer does not receive any correspondence regarding the updates of the application, it is advisable to call on the IRS toll-free number at 1-800-829-1040 to request the status of your application if you are in the US. If you are residing outside the US, call on their toll free number.

Through this service, the IRS enables its taxpayers to track their application status, seven weeks after submitting W-7 and the tax return.

Why Meru Accounting

Meru Accounting is a well-known name in the USA for providing top-notch remote accounting services. It has a loyal client base in the USA and also all over the world. We are not only best in providing error-free and on-time services, but we also offer the most affordable price in the field.

The U.S. Income Tax Return for S-corp seems to be a bit complicated than the other tax returns. Hence you can rely on our experienced team of experts to get it done on time while you invest your own precious time into your business.

Step 01. Document Requisition

Remote Login

Our clients can scan and upload the required documents on their server or e-fax the documents to us. Our expert team will log in to our clients' system using any secure virtual technology like Netsonic, VPN/RDP/TeamViewer and complete the procedure on their behalf.

Using Cloud based Software

The clients can upload the scan copies of the required documents on a secure FTP server or send them by e-fax messenger, Google drive or Dropbox. The client also needs to provide their login details for the online software via our secure mailing system. Our team will then sign in and complete the following procedure. The data will be saved on cloud.