Form 1065

U.S. Tax Return for

Partnership Income

Get Expert Advice

Form 1065 – U.S. Tax Return For Partnership Income

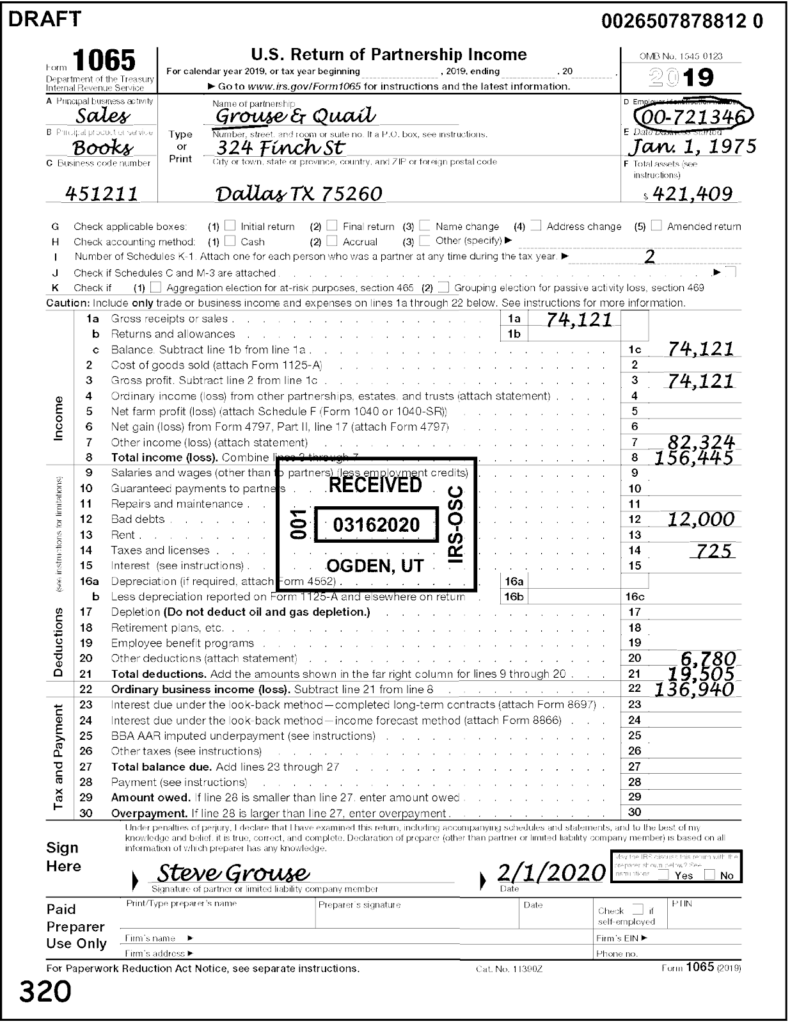

Form 1065 is used for the U.S. Tax Return for Partnership Income. It is a particular type of IRS tax return form, which is used for partnerships and multi-member LLCs to report the company’s annual financial data. If your business is an LLC and you have decided for it not to be taxed as a cooperative company for the year, then you have to submit a form 1065. Partners need to include data about the company’s profits/losses, deductions, and payments in the form. They should also file Schedule K-1 form stating each partner’s share. Meru accounting is best in the field to provide the best remote support and services for Form 1065 filing.

Structure Of Form

Information Required From The Client

We will provide you a checklist of all the required documents and essential information. You need to provide us with all those data and documents that we can fill up the U.S. Tax Return for Partnership Income form without any flaw.

To fill-up the form 1065, you need to provide us all of your partnership financial statements, a profit-loss statement that reflects net income and revenue, a list of all deductible expenses, and a year-end balance sheet. If your company sells goods, you need to provide data for calculating the cost of goods sold. Also, if you pay more than $600 to any contractual worker or any of the owners is paid more than the standard profit share, you have to provide the details. Apart from all these, you have to provide your Employer Identification Number / Tax ID, business starting date, Business Code Number, business partner details.

Some of the documents or information can be difficult to obtain. In such cases, you can always coordinate with our tax expert to ensure the information is accurate.

Due Date Of Filing

The U.S. Income Tax Return for S-corp tax seems to have more tricky deadlines than the personal tax return dates since there’s no fixed date. However, the due date for submitting Form 1120S is technically by the 15th of the third month after the end of the financial year.

Our Process

At Meru Accounting, we make the Form 1065 return procedure smooth and hassle-free.

After you send us the required documents according to the checklist, we follow some steps to make the procedure flawless and hassle-free for you

Step 02. Processing Documents

Preparation for Tax Return

The relevant information from the documents will be taken into a software of the client's choice by our tax professionals. The scanned copies of the original documents along with the transactions will be saved into the software in order to make them easily accessible. All the copies of the documents would be verified with the source documents.

Auditing of Tax Returns

Our experts will then verify if all the required information has been correctly entered. The Tax expert will then prepare the Tax return report based upon bookkeeping done for the given period and the information received.

Step 03. Final Preparations

Review of Returns

A draft copy of the tax return with the calculated Tax Refunds/ Liability will be sent to the client for review. The draft will include some questions or comments from the Tax expert. The client can request for multiple modifications if needed.

Submission of the Final Copy of the Tax Return to the client

After reviewing the tax returns, the final copy for the income tax return will be sent before the due date. The clients just need to sign and send the Tax return file to the Internal Revenue Service via some designated UPSC courier services like DHL Express, UPS and FedEx. We will take care of all the communications part with the Internal Revenue Service if any query arises.

Why Meru Accounting?

For the last five years, Meru Accounting has been the leading name in the field of remote accounting services and numerous happy clients in the USA. We have a team of experts who provide you the top-notch outsourcing solutions for the U.S. Tax Return for Partnership Income.

We are the certified user of the most secure accounting software like Xero, Quickbooks, Netsuite. We provide you accurate and error-free financial reports at an affordable rate. Also, we regularly update the data and keep our clients daily updated about the work progress and take care of end to end communication with the IRS on behalf of the client if required.

FAQs

Partnerships are written in a formal agreement, which says if you’re a general, limited, or limited liability partnership.

Partnership, unlike a corporation, is not a distinct legal entity from the owners.

You should file form 1065, Schedule K 1 forms, and input all the details.

Step 01. Document Requisition

Remote Login

Our clients can scan and upload the required documents on their server or e-fax the documents to us. Our expert team will log in to our clients' system using any secure virtual technology like Netsonic, VPN/RDP/TeamViewer and complete the procedure on their behalf.

Using Cloud based Software

The clients can upload the scan copies of the required documents on a secure FTP server or send them by e-fax messenger, Google drive or Dropbox. The client also needs to provide their login details for the online software via our secure mailing system. Our team will then sign in and complete the following procedure. The data will be saved on cloud.