Hire Remote Bookkeeper, Accountant , Tax return Preparer or Admin Person

Monthly Bookkeeping, Payroll, Financial Statements & Tax returns for Wholesale and Distribution Business

Quality Driven Approach

QuickBooks And Xero Certified Experts

50% Reduction

In Costs

Part Time / Full Time Resources For

- CPA Firms

- Enrolled Agents

- Bookkeeping Firms

- Tax Practitioners

- Business Owners

Hire Remote Team

Certificate Expertise

Freshbooks

Freshbooks

Freshbooks

Freshbooks

Bookkeeping Software Expertise

saasu

wave

Freshbooks

odoo

Xero Gold Partner

zoho books

simply accounting by sage

yendo

“& many more”

Our Services

VAT Return

File accurate and timely returns, meet tax compliances and avoid the possibility of hefty fines and penalties being imposed by UAE tax authorities.

Monthly Financial Statement

Get a clear view of the financial health of your organization with monthly financial statements prepared by professional accountants or certified public accountants.

Accounts Receivable Management

Manage your outstanding invoices, improve chances of getting paid within a reasonable timeframe and accelerate your cash flows with the efficient internal system.

Accounts Payable Management

Build a robust and organized accounts payable process to make payments efficiently, cost-effectively and accurately, thus lowering the cost of operations of your business.

Reconciliations

Reconcile and match all your balances to eliminate the chances of irregularity in accounts and avoid any discrepancy between the stated balance and the actual balance held.

Cash Flow, Budgeting and Forecasting

Understand your cash flows and prepare budget forecasts with ease and accuracy based on our data-backed projections and analysis.

Accounting Services

- Records, Bookkeeping and Cash Reporting systems implemented

- Maintenance of Monthly Books

- Monthly Reports of Financial Statements

- Bank and Ledgers Reconciliation

- MIS Reporting (Yearly)

- ESR Review

- Internal Audit and Review

AED 499/-

Price Table

- AED 500/- month from 1 to 100 transactions

- AED 1050/- month from 101 to 400 transactions

- AED 1400/- month from 401 to 700 transactions

- AED 2000/- month from 701 to 1500 transactions

- AED 3000/- month from 1501 to 3000 transactions

We are the 1st choice of businesses for accounting and bookkeeping services in UAE. Here’s why!

Cost Savings Up To 50%

Reduce up to 50% of your operation costs and save huge costs on hiring and training in-house employees. We offer cost-effective online accounting and bookkeeping services that start at as low as US $10 per hour.

Skilled Team

We have a dedicated and skilled team of certified professionals who have in-depth knowledge and understanding of how bookkeeping works in different industries in the UAE. We have a time-tested and proven track record of over a decade for being one of the best bookkeeping and accounting firms in the UAE.

Quick Turnaround

We ensure quick turnaround time and hassle-free operations. We guarantee 24 hours TAT in most cases. However, the turnaround time depends on numerous factors such as project size, complexities involved, type of project and urgency of deliverables, among other things.

Robust Infrastructure

With a world-class infrastructural setup and productive resources, we ensure uninterrupted and timely services to our clients. We have a highly advanced infrastructure to support every latest technology that comes in the field of accounting.

Security and Privacy

Meru Accounting is an ISO 9001:2015 & ISO 27001:2013 certified company. We strictly follow all the safety and security norms to protect the confidentiality and secrecy of our client’s critical data.

Real-Time Access

Because of cloud-based accounting, you get access to your real-time bookkeeping and accounting records, financial data and reports anytime and from anywhere. Your numbers always remain at your fingertips.

Flexible Engagement Model

You can anytime scale up or scale down our services as per your requirements. You can hire us on an affordable hourly rate basis or a fixed-fee arrangement based on your number of transactions per month, company size, number of employees and revenue.

Quality Service

We maintain high quality standards in everything we do. Our primary motto is to deliver quality services to our clients and within the given time frame. This sets us apart from our competitors.

Cloud AddOns Expertise

Cloud AddOns Expertise

Hubdoc

With Hubdoc, you can automatically import all your financial documents & export them into data you can use.

Gusto

Gusto offers fully integrated online payroll services includes HR, benefits, and everything you need for business.

Spotlight Reporting

Attractive performance reports quickly and efficiently. Ideal for organizations that need deeper insight and analysis.

Receipt Bank

Receipt Bank converts those annoying bits of paper – receipts and invoices – into Xero data!

AutoEntry

AutoEntry captures, analyses and posts invoices, receipts and statements into your accounting solution.

Shopify

Connect Shopify and Xero to effectively manage your online sales, inventory and accounting requirements.

Accounting and Bookkeeping for the Wholesale Industry in UAE

Core Aspects of the Wholesale Industry in UAE

Diverse Product Range:

One core aspect of the wholesale industry is its focus on bulk purchasing. The UAE Wholesale Industry deals with a wide variety of products, ranging from food and beverages to construction materials, electronics, and more. This diversity requires precise tracking of inventory and finances. Wholesalers source products from manufacturers at lower prices due to their ability to buy in large quantities. They then sell these goods to retailers who can benefit from economies of scale by purchasing in bulk themselves.

Market Competition:

Wholesale companies must ensure efficient transportation and storage systems to handle large volumes of goods effectively. Timely delivery is crucial for maintaining good relationships with both suppliers and customers. The UAE has a highly competitive Wholesale Industry, where businesses need to stay agile and cost-effective to remain competitive in this dynamic market.

Global Trade Hub:

The UAE is a global trade hub, making it a strategic location for businesses involved in import and export. This adds complexity to financial transactions, requiring careful accounting and reporting. Wholesalers often deal with international suppliers and customers, necessitating the management of currency exchange rates, import/export duties, and compliance with international trade regulations.

Regulatory Environment:

In this competitive landscape, staying ahead requires accurate financial management. Accounting and bookkeeping are essential for tracking sales revenue, inventory levels, expenses related to warehousing and distribution operations while ensuring compliance with regulatory requirements.

Why do we need accounting and bookkeeping for the Wholesale Industry in the UAE?

Financial Transparency:

Accurate financial records provide transparency into the financial health of the business. In a sector where significant transactions occur regularly, this transparency is crucial for investors, lenders, and stakeholders. It enables them to assess the financial stability and performance of the wholesale business.

Tax Compliance:

The UAE has implemented Value Added Tax (VAT) and other taxation policies. Proper accounting ensures accurate tax calculations and reporting, helping businesses avoid penalties. Wholesale businesses engage in numerous financial transactions, including imports, exports, and local sales. Navigating the UAE's tax regulations can be complex.

Risk Management:

Timely financial reporting allows businesses to identify and mitigate financial risks promptly. In the fast-paced Wholesale Industry, staying ahead of potential financial challenges is critical. Robust accounting practices help in early detection of cash flow issues, market risks, and liquidity concerns, enabling businesses to take proactive measures to mitigate these risks.

Operational Efficiency:

Effective bookkeeping streamlines operations by providing insights into cash flow, inventory management, and cost control. Wholesale businesses deal with large inventories and a constant flow of goods. Maintaining systematic and accurate records of sales, purchases, and inventory levels is vital for smooth operations.

How can accounting and bookkeeping help the Wholesale Industry in the UAE?

Accurate Financial Reporting:

Properly maintained records ensure accurate financial statements, enabling businesses to assess their financial performance and make informed decisions. In a sector where large volumes of transactions occur daily, accurate financial reporting is essential. It provides business owners and stakeholders with a clear view of the company's financial health, helping them calculate profitability and make data-driven decisions.

Cost Control:

Detailed financial records help identify areas where costs can be reduced, increasing overall profitability. In a highly competitive environment, cost control is paramount. Accounting and bookkeeping allow wholesalers to scrutinize their expenses, identify inefficiencies, and make informed decisions to reduce costs.

Enhanced Cash Flow Management:

Effective bookkeeping ensures that cash flow remains steady, preventing cash shortages or over-investing in inventory. Wholesale businesses often deal with large volumes of inventory and fluctuating demand. Maintaining proper records of transactions and inventory levels allows wholesalers to manage their cash flow effectively.

Profitability Analysis:

Accounting provides valuable insights into profitability analysis. Wholesalers can assess which products are generating higher profits versus those that may not be performing as well. This information allows wholesalers to adjust pricing strategies, focus marketing efforts on profitable products, or make informed decisions about which products to promote or discontinue.

Benefits of accounting and bookkeeping for Wholesale Industry in UAE

Financial Accuracy

Avoid costly errors and financial discrepancies by maintaining precise records. In a sector where every financial transaction counts, accuracy is paramount. Professional accounting and bookkeeping services ensure that all financial data is recorded correctly. This precision minimizes the risk of errors that could lead to financial losses or regulatory non-compliance.

Time Savings:

Outsourcing accounting and bookkeeping tasks allows businesses to focus on core operations. Managing finances can be a time-consuming endeavor. By delegating these responsibilities to experts, wholesale businesses can free up valuable time and resources to concentrate on their core activities, such as sourcing products, expanding market reach, and improving customer service.

Cost Efficiency:

Avoid the expenses of hiring and training an in-house accounting team by partnering with a specialized service provider. Maintaining an in-house accounting department comes with substantial costs, including salaries, benefits, training, and software expenses.

Expertise:

Leverage the expertise of professionals who understand the unique challenges and opportunities in the Wholesale Industry. The Wholesale Industry in the UAE has its own set of complexities, including compliance with local laws, taxation, and handling large volumes of transactions. Professional accountants and bookkeepers with industry-specific knowledge can navigate these challenges effectively.

Meru Accounting's Accounting and Bookkeeping services for Wholesale Industry in the UAE

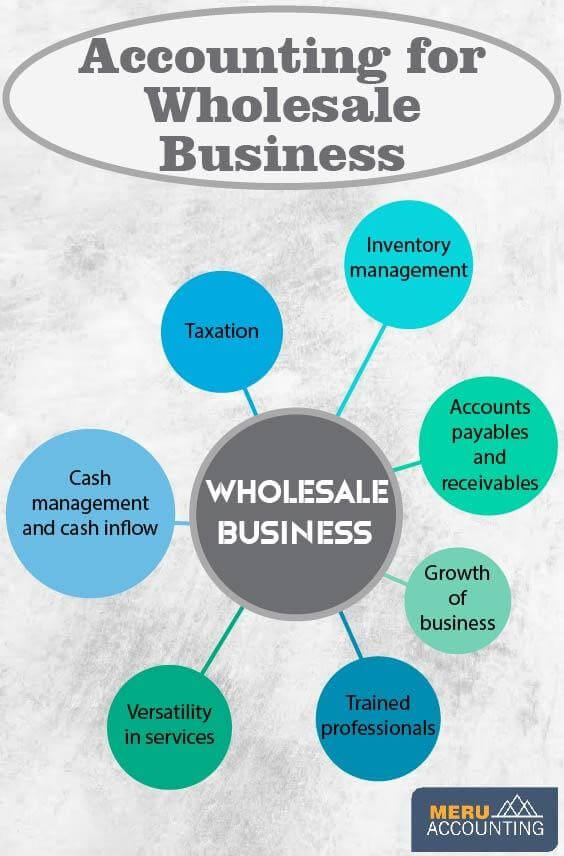

Accounting for Wholesale Business

Inventory management:

Wholesale businesses involve managing huge inventories that comprises numerous transactions among various suppliers and retailers. Thus, understanding these dynamics of this industry we at Meru Accounting use an array of accounting software that makes inventory management easy and hassle-free and our clients can focus on their business with no worry.

Cash management and cash inflow:

Managing cash and their inflow is very essential and a priority for any industry. So, cash flow is a must to run a business and to maintain its financial stability. Understanding this need, we at Meru Accounting provide our clients with effective cash management and cash flow management so they can grow with no hassle.

Accounts payables and receivables:

We understand the importance of payables and receivables, as we know that it can affect the cash flow of a company. That’s why we also provide the services of account payables and receivables management apart from the bookkeeping services.

Growth of business:

The wholesale industry is widely affected by different rules and regulations as the suppliers and purchasers can be from any industry. Thus it’s very important to be aware about the nitty-gritty of various sectors as well. We have experience in dealing with changing dynamics of this industry and thus we provide our wholesalers clients with impeccable services which at the end help their business to grow, as we believe that their growth is our growth.

Trained professionals:

We at Meru Accounting have a highly trained professional workforce to meet our clients’ requirements. We train our team of professionals to handle the accounting and reconciling tasks at different levels in the supply chain, retailers, and manufacturers, so we can provide our wholesale clients with the best of our services.

Versatility in services:

With the era of digitalization, we also offer these services to both online merchants and brick and mortar wholesalers.

Taxation:

Tax filing is a must for any given industry. It takes a lot of time and effort for a company to calculate the taxes to be paid. That’s why we provide our clients with taxation facilities. Our experts effectively calculate the accurate taxes, so that our clients can concentrate on their core part without worrying about the complications of taxes.

In the UAE’s competitive Wholesale Industry, accounting and bookkeeping are essential tools for success. Accurate financial reporting, compliance with regulations, and strategic financial management are paramount. These practices empower businesses to make informed decisions, enhance operational efficiency, and maintain financial transparency. Outsourcing to specialized service providers like Meru Accounting saves time and resources, enabling a sharper focus on core operations.