Hire Remote Bookkeeper, Accountant , Tax return Preparer or Admin Person

Monthly Bookkeeping, Payroll, Financial Statements & Tax returns for Renting Sector Leasing Services Industry

Quality Driven Approach

QuickBooks And Xero Certified Experts

50% Reduction

In Costs

Part Time / Full Time Resources For

- CPA Firms

- Enrolled Agents

- Bookkeeping Firms

- Tax Practitioners

- Business Owners

Hire Remote Team

Certificate Expertise

Freshbooks

Freshbooks

Freshbooks

Freshbooks

Bookkeeping Software Expertise

saasu

wave

Freshbooks

odoo

Xero Gold Partner

zoho books

simply accounting by sage

yendo

“& many more”

Our Services

VAT Return

File accurate and timely returns, meet tax compliances and avoid the possibility of hefty fines and penalties being imposed by UAE tax authorities.

Monthly Financial Statement

Get a clear view of the financial health of your organization with monthly financial statements prepared by professional accountants or certified public accountants.

Accounts Receivable Management

Manage your outstanding invoices, improve chances of getting paid within a reasonable timeframe and accelerate your cash flows with the efficient internal system.

Accounts Payable Management

Build a robust and organized accounts payable process to make payments efficiently, cost-effectively and accurately, thus lowering the cost of operations of your business.

Reconciliations

Reconcile and match all your balances to eliminate the chances of irregularity in accounts and avoid any discrepancy between the stated balance and the actual balance held.

Cash Flow, Budgeting and Forecasting

Understand your cash flows and prepare budget forecasts with ease and accuracy based on our data-backed projections and analysis.

Accounting Services

- Records, Bookkeeping and Cash Reporting systems implemented

- Maintenance of Monthly Books

- Monthly Reports of Financial Statements

- Bank and Ledgers Reconciliation

- MIS Reporting (Yearly)

- ESR Review

- Internal Audit and Review

AED 499/-

Price Table

- AED 500/- month from 1 to 100 transactions

- AED 1050/- month from 101 to 400 transactions

- AED 1400/- month from 401 to 700 transactions

- AED 2000/- month from 701 to 1500 transactions

- AED 3000/- month from 1501 to 3000 transactions

We are the 1st choice of businesses for accounting and bookkeeping services in UAE. Here’s why!

Cost Savings Up To 50%

Reduce up to 50% of your operation costs and save huge costs on hiring and training in-house employees. We offer cost-effective online accounting and bookkeeping services that start at as low as US $10 per hour.

Skilled Team

We have a dedicated and skilled team of certified professionals who have in-depth knowledge and understanding of how bookkeeping works in different industries in the UAE. We have a time-tested and proven track record of over a decade for being one of the best bookkeeping and accounting firms in the UAE.

Quick Turnaround

We ensure quick turnaround time and hassle-free operations. We guarantee 24 hours TAT in most cases. However, the turnaround time depends on numerous factors such as project size, complexities involved, type of project and urgency of deliverables, among other things.

Robust Infrastructure

With a world-class infrastructural setup and productive resources, we ensure uninterrupted and timely services to our clients. We have a highly advanced infrastructure to support every latest technology that comes in the field of accounting.

Security and Privacy

Meru Accounting is an ISO 9001:2015 & ISO 27001:2013 certified company. We strictly follow all the safety and security norms to protect the confidentiality and secrecy of our client’s critical data.

Real-Time Access

Because of cloud-based accounting, you get access to your real-time bookkeeping and accounting records, financial data and reports anytime and from anywhere. Your numbers always remain at your fingertips.

Flexible Engagement Model

You can anytime scale up or scale down our services as per your requirements. You can hire us on an affordable hourly rate basis or a fixed-fee arrangement based on your number of transactions per month, company size, number of employees and revenue.

Quality Service

We maintain high quality standards in everything we do. Our primary motto is to deliver quality services to our clients and within the given time frame. This sets us apart from our competitors.

Cloud AddOns Expertise

Cloud AddOns Expertise

Hubdoc

With Hubdoc, you can automatically import all your financial documents & export them into data you can use.

Gusto

Gusto offers fully integrated online payroll services includes HR, benefits, and everything you need for business.

Spotlight Reporting

Attractive performance reports quickly and efficiently. Ideal for organizations that need deeper insight and analysis.

Receipt Bank

Receipt Bank converts those annoying bits of paper – receipts and invoices – into Xero data!

AutoEntry

AutoEntry captures, analyses and posts invoices, receipts and statements into your accounting solution.

Shopify

Connect Shopify and Xero to effectively manage your online sales, inventory and accounting requirements.

Accounting and Bookkeeping for the Rental Business in UAE

Core Aspects of the Rental Business in UAE

Rent Caps:

Rent caps are an integral part of the UAE's rental landscape. These regulations dictate the maximum allowable rent increase for existing tenants. Adhering to rent caps helps maintain affordability and prevents arbitrary rent hikes, ensuring stability and fairness in the rental market.

Cash Flow Management:

Effective cash flow management is the lifeblood of any successful rental business in the UAE. The need to maintain and repair properties, acquire or lease assets, and cover operational expenses underscores the significance of good financial management. Efficient cash flow management ensures that a rental business remains financially strong and capable of seizing opportunities and overcoming challenges in a competitive landscape.

Pricing Strategies:

Setting competitive rental rates is another crucial aspect of the rental business in the UAE. Factors such as demand, seasonality, market trends, and operational costs all play crucial roles in determining pricing strategies. Striking the right balance between attracting customers and ensuring profitability is essential to sustain and grow in this thriving sector.

Customer Service:

Exceptional customer service is the basis of success in the UAE's rental industry. Providing support throughout the rental process, from quick response times to clear communication channels and prompt issue resolution, builds trust and encourages positive word-of-mouth referrals. Repeat customers and a strong reputation are often the rewards of outstanding customer service.

Marketing Efforts:

To thrive in this competitive landscape, rental businesses in the UAE must implement effective marketing strategies. Targeted advertising campaigns through various channels like social media platforms and industry-specific websites increase brand visibility and help reach potential customers who require rentals for specific projects or events.

Why do we need accounting and bookkeeping for Rental Business in UAE?

Renovation and Upkeep:

Accounting records help rental businesses allocate funds for property renovations and maintenance systematically, preserving the property's value and attracting quality tenants.

Lease Management:

Keeping track of lease agreements, renewal dates, and rent adjustments is crucial. Accurate records prevent missed deadlines, lease disputes, and potential revenue loss.

Budget Variance Analysis:

Regular financial reports enable rental businesses to compare budgeted expenses with actual costs. This analysis helps identify areas where cost-saving measures can be implemented.

Asset Portfolio Diversification:

With a clear financial overview, rental businesses can make informed decisions about diversifying their property portfolio by acquiring assets in different locations or categories.

Financial Transparency:

Transparency is crucial in the UAE's rental industry. Accurate financial records provide a clear window into a rental business's financial affairs. This transparency extends to stakeholders, including investors, partners, and government authorities. Such transparency builds trust, enhances credibility, and ensures smooth business operations.

Cost Control:

Effective cost management is central to the profitability and sustainability of rental businesses. By carefully tracking income and expenses, rental companies can pinpoint cost-saving opportunities and optimize their operations.

Risk Management:

Financial risks are inherent in any business, and the rental industry is no exception. Accounting plays a crucial role in identifying these risks and developing strategies to mitigate them.

Building Credibility:

For rental businesses seeking additional funding or partnerships, maintaining accurate books is crucial. Credible financial records established through accounting and bookkeeping practices enhance the business's appeal to potential investors or lenders.

How can accounting and bookkeeping help the Rental Business in the UAE?

Accurate Record-Keeping:

By maintaining precise records of income and expenses, rental businesses can track cash flow accurately. This enables them to identify trends, pinpoint profitable properties, and make necessary adjustments to enhance overall profitability.

Expense Monitoring:

Bookkeeping ensures that all payments, from utility bills and maintenance costs to property taxes and insurance premiums, are accurately recorded. Categorizing expenses into different accounts, such as repairs/maintenance or property management fees, allows owners to analyze spending patterns efficiently.

Financial Health Assessment:

Detailed financial documentation facilitates the generation of critical reports, such as profit and loss statements or balance sheets. These reports provide a clear picture of the rental business's financial health, highlighting areas for improvement and potential risks.

Tax Compliance:

The UAE's tax regulations are strict, making accurate record-keeping crucial. Detailed financial documentation not only ensures compliance but also simplifies the tax filing process. It provides evidence in case of audits and ensures that all eligible deductions are claimed.

Operational Streamlining:

Bookkeeping streamlines operations by introducing efficient systems, such as automated rent collection processes and tracking overdue payments. These systems enhance efficiency while reducing errors and missed revenue opportunities.

Benefits of Accounting and Bookkeeping for the Rental Business in UAE

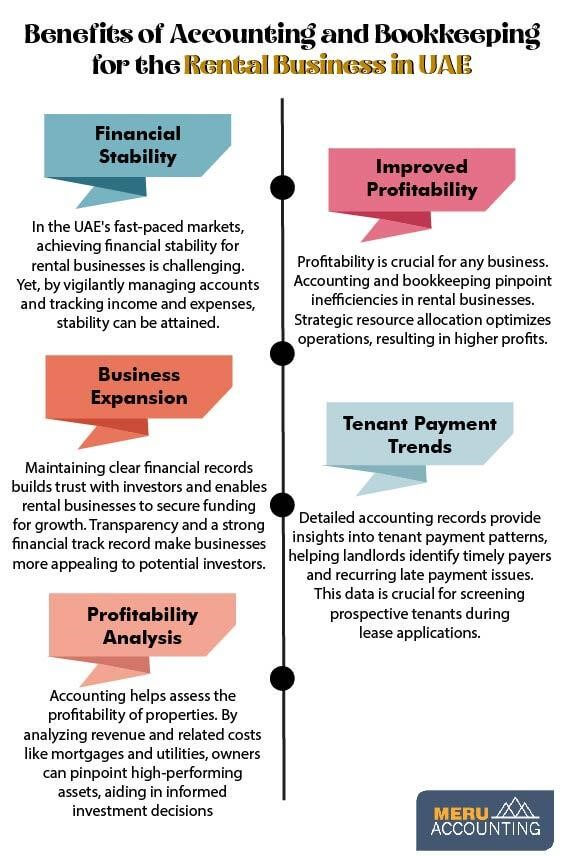

Financial Stability:

In the UAE's dynamic and occasionally volatile markets, maintaining financial stability is no small feat. However, by consistently tracking income and expenses through diligent accounting and bookkeeping, rental businesses can achieve just that.

Improved Profitability:

The pursuit of profitability is at the heart of any business venture. Accounting and bookkeeping practices help rental businesses identify areas of inefficiency. By carefully allocating resources, these businesses can optimize their operations, leading to increased profitability.

Business Expansion:

Growth and expansion often require external funding and investor trust. Well-maintained financial records and reports attract potential investors and secure financing for expanding the rental portfolio. Investors are more likely to partner with businesses that exhibit financial transparency and a track record of good financial management.

Profitability Analysis:

Accounting provides the means to analyze the profitability of different properties or units. By comparing revenue generated against related costs, such as mortgages, insurance premiums, or utility bills, owners can identify financially high-performing assets and make informed decisions about future investments.

Tenant Payment Trends:

Detailed accounting records also offer insights into tenant payment trends. Landlords can determine if tenants consistently pay on time or if there are recurring issues with late payments. This data is invaluable when screening new tenants during the lease application process.

Accounting for Rental Properties – Meru Accounting

- Profit Margins in the rental business can be quite challenging whether it is a machine rental business or a property rental business.

- However, a Rental business can be a highly profitable business if one adequately amortizes the capital cost against the receipts.

- We at Meru Accounting provide reporting for a rental business to help you analyze revenue per working hour of the machine.

- We at Meru Accounting can help you plan and budget your revenue based on various inputs and can let you know whether the machine can be worth investing in your rental business.

Tracking of income per property

- You should track income on the property based on class tracking for real estate.

- You should maintain a separate bank account per property so that you can easily allocate the expenses to that property.

Regular updating of books of accounts

Tracking of Expenses via Property

- One should track expenses via property for each property.

- General expenses that cannot be allocated specifically to a property should be assigned on either the proportion of income, the area occupied, or any other scientific basis.

Features that you should look into while selecting accounting software

- Ability to manage apartments, commercial properties, condominiums, cooperatives, homeowner associations, residential properties, etc.

- Ability to operate in a Cloud environment

- Collect rent online

- Automatic invoicing

- Listing management

- Alerts for software

- Expense management

- Vacancy Tracking

- Maintenance of task

Conclusion

Accounting and Bookkeeping for the Rental Business in UAE

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

Help you with switching from your traditional software to Xero and Quickbooks.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

When you choose to outsource your accounting work with us, it benefits you in the following ways:

- 1. Cost-saving

- 2. Access to skilled and experienced professionals

- 3. Better management of books of accounts

- 4. Decreased chances of errors

- 5. Improve business efficiency

- 6. De-burdens in-office employee’s dependency

- 7. Better turnaround time

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software.

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

WE'RE HAPPY TO ANSWER

CONTACT US FOR ANY QUESTIONS

Our office address

Global Production Team (India)

902, Shivalik Tower, Nr. Panchvati Cross Roads, Ahmedabad, Gujarat 380009,India